What exactly is Syndicated credit? To build a small or large scale company we need funds. Have you ever been curious about where investors or owners of large companies get money to build a company? The money owned by the owners of this company indeed come from loans from a bank. But you certainly know that the number of loans that can be borrowed from one bank is very limited. What is syndicated credit and how can companies take benefits from syndicated credits?

Who provides loans to companies?

Because almost all banks, savings and loan cooperatives in Pakistan will provide loans according to the price of collateral submitted. Then where do these investors get a lot of capital? The answer is from syndicated loans. This type of credit has indeed been used for a long time.

Definition of Syndicated Credit:

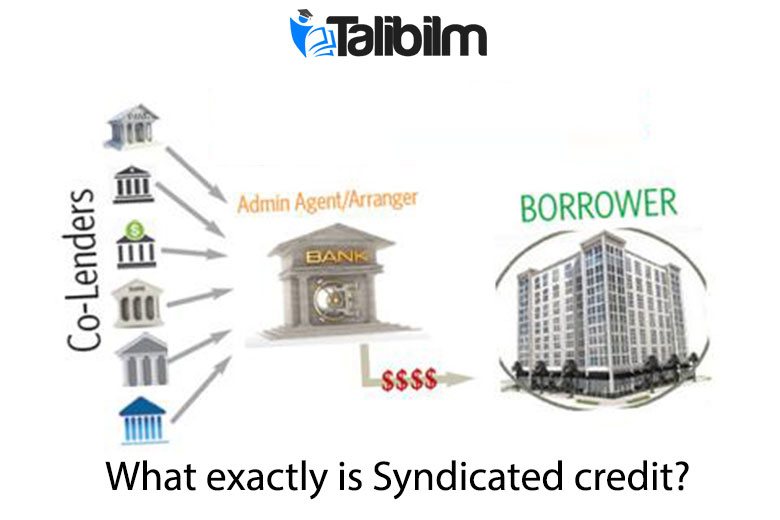

What exactly is Syndicated credit? Those of you who are economic students already know about syndicated loans. Syndicated credit is a loan or credit given by several banks at once to a debtor or borrower of money. The reason why is given by many banks is because the amount of loan money is too much if it is covered only from one bank.

In other words, a syndicated loan is a loan that involves several banks at once and one debtor in one type of credit. Usually syndicated loans are given to debtors who need money loans to make investment loans or working capital loans.

Syndicated credit has any interest?

Although credit is given by several banks at once, it does not mean that the loan has no interest. Syndicated loans continue to bear interest and the amount of interest in accordance with the agreement that has been agreed upon previously. Likewise, the time of repayment of the loan must be in accordance with the credit agreement that has been signed between all the lending banks and the debtor.

Whom syndicated loan is not given?

But you need to know how can the credit indication not be given to some debtor? Because only certain debtors who meet the credit requirements can get syndicated loans. These requirements are not easy to fulfil by everyone. Usually debtors who are approved to apply for syndicated loans are well-known investors and entrepreneurs who have good business records.

Why do we need for Syndicated Credit?

In fact, syndicated loans do not only exist in Pakistan but have reached international banking. This means that syndicated loans are really needed by every debtor or company owners in the entire world. Indeed, the benefits of syndicated loans are many, especially for entrepreneurs who are already successful and want to re-develop their business.

Is syndicated loan Islamic or not?

We should know that Islam does not allow us dealing in the name of interests. If the debtors take loan from Islamic banks, then all legal and Halal rules will be applicable on obtaining the loan.

Which Companies need syndicated loans?

The first reason for making syndicated loans is because many companies need this type of credit. Where not only privately owned companies that use syndicated loans. However, many national, multinational and government-owned companies use syndicated loans.

What is the risk in syndicated loan?

The amount of money lent on syndicated loans is indeed large considering the company is the one who needs this credit. Because syndicated loans involve many banks, the loan risk is smaller. Where if the debtor does not pay, the losses suffered by each bank are not too large.

The big amount of loan is needed by companies

As mentioned earlier, syndicated loans involve many banks because the amount of loans is very large. And this is the main reason why syndicated loans are applied. By merging several banks into one, the amount of funds needed by a company can be fulfilled.

A chance to Increase the number of debtors

Usually every bank wants to be part of this syndicated loan, because the individual borrowers of money at the bank can be increased dramatically. This is because the reputation of the bank is enhanced when they offer syndicated loans for big companies. Borrowers feel easy to take loans from such banks.

Obviously, the trust of general borrowers is cashed by banks in multiple ways. That’s all in the favor of banking institutes.