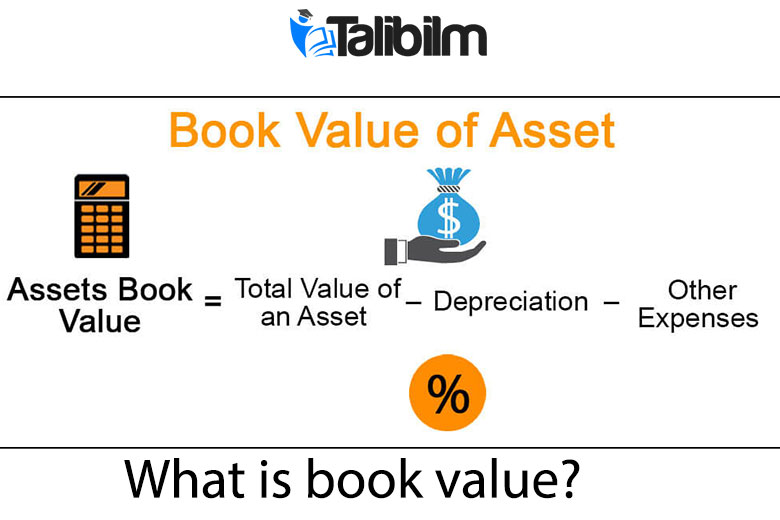

What is book value? Book value is a term that is often found in accounting books. According to Dictionary, the book value is the value of the company’s assets listed in the account-bearing notes (information), generally not the same as the market value; usually, what is recorded is the price at which the asset was purchased; every year the value of the asset is reduced or depreciated and the reduction in value is charged to the company’s income; book value is the cost less accumulated depreciation.

What is book value?

In short, book value is the value held by an asset in the balance sheet or bookkeeping. If the value of an asset is depreciated, the book value of the asset is equal to the purchase price less the accumulated depreciation.

Book value = Asset value – accumulated depreciation of assets

The book value for one type of asset in the same period can differ from one company to another. The reason is the book value of an asset is affected by the depreciation method used by the company concerned.

Companies that use the straight-line asset depreciation method will have different results from companies with the declining balance depreciation method. Even though the initial value of the asset is the same at the beginning, it can be very different later after experiencing depreciation.

Purpose of Book Value

Determining the book value of an asset is certainly not without a clear purpose. In accounting, there are 2 main objectives for book value, namely:

Shows the monetary value of a company’s assets, which will later be received by the owner if the company must be liquidated one day.

When compared to market value, book value can give an idea of whether a company is sold at a price above or below the market price.

Book value can not only be applied to corporate finance, but also for personal finance, especially for calculating investments. Book value is the price of the investment paid to obtain assets. When companies conduct stock transactions, the selling price reduced by book value is the profit or loss on the investment.

Determine the depreciation method

Depreciation is a business expense that can reduce the amount of income and tax burden. The amount of depreciation not only depends on the type of asset, but also the method of depreciation used. The straight-line method is the most common method of calculating depreciation. But there are also other methods such as a declining balance that can be used.

The straight-line method is the most commonly used method to maintain depreciation expense so that it does not get bigger and more consistent over the lifetime of the asset.

The declining balance method and the number of years can be used to calculate the depreciation value of the assets that are considered the most useful and most productive at the beginning of the useful life, but decrease as they approach the end of their useful life. This method is widely applied to production machines whose capabilities are increasingly decreasing.