In this short piece of article let us tell you what is disposable income and how can we take maximum benefit from disposable income. In the financial world there is another business term, what is called disposable income. This term is very common and must be understood in easy way. In order to manage your finances well, you must understand what disposable income is, where it comes from, and how to manage disposable income properly.

Definition of disposable income:

What is disposable income? Disposable income is the result of a reduction between personal income and direct tax.

What is direct tax?

What is meant by direct tax? Basically, it is a land and building tax, motor vehicle tax, and so forth. Disposable income is the amount of income that can be used to save and finance daily needs.

Managing personal finance with disposable income

Disposable income is a very important aspect of managing personal and family finances because it is the net income that a person receives each month. How disposable income is used, whether all of it is to be saved, is spent on daily needs, or to invest entirely depends on how a person manages it.

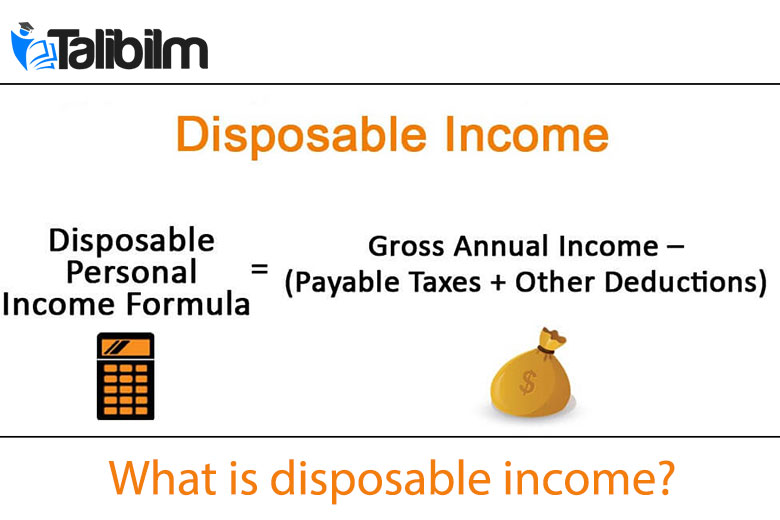

How to Calculate Disposable Income?

Before further discussion, here is the formula for calculating disposable income in one year.

Disposable Income = Gross Annual Income – (Direct Tax + Other Deductions)

Disposable income: Remaining income after deducting taxes and other dependents

What is Gross annual income?

The amount of revenue received in one year

Direct taxes & other deductions: Taxes that must be paid annually such as land and building taxes and motor vehicle taxes.

Disposable income to measure finance

In the economic world, disposable income is widely used as a measure of the economic health of a person or an organization. The higher the amount of disposable income, the healthier the economic condition. With disposable income in large quantities, a person has a greater purchasing power, has the opportunity to save money and he has a larger investment and a more secure life in the long run.

Personal saving Ratio

The amount of disposable income also reflects whether a person or a household saves more or has more debt. Disposable income has many functions, including to measure a person’s level of personal savings.

What is Disposable Income and Discretionary Income?

After you receive a salary, then pay taxes and so on, the remaining money is disposable income. But actually not all of them are disposable income. How come?

Simple example for disposable income

Now subtract disposable income from the basic needs that must be paid. Like the needs of shopping for food, mortgage, transportation costs, health insurance, education insurance, and others. After that, there will be more money called discretionary income.

What is discretionary income?

Unlike the disposable income that must be used to meet basic needs that are not replaceable, discretionary income is money that can be used for fun without having to be burdened because all mandatory expenses have been fulfilled. You can use discretionary income at will.

This type of income is to eat out, invest, save, holiday, and other tertiary needs. Even you are free to use discretionary income for a variety of needs that are not important, but still within reasonable limits.

Managing Disposable Income is an art

How you make budgeting for disposable income depends on what budgeting system you implement. Apart from that, there are several points to consider when you are preparing a budget for disposable income.

First, make priority. Write down what things you want to do with this disposable income. Make sure basic needs are at the top of the list. Basic needs include food purchases, bill payments, installment payments, and insurance payments. After all the mandatory requirements are met, the remaining amount of money you have is discretionary income.

Although discretionary income is money for fun because your basic needs have been met, you must use them wisely. There are several choices that can be made to spend disposable income such as investment, savings, holidays, and other fun activities that tend not to be important.

Make priorities for discretionary income

This is the important part for making priorities for discretionary income. Which one comes first, saving first or investing first? Invest first or vacation first? These things must be carefully considered.

The second point that must be considered when managing a disposable income budget is to adjust lifestyle. Here you must be honest and realistic with yourself. How your lifestyle really determines your way to manage this disposable income.

So, if you have sufficient income then try to save more so that you see continuity in your extra funds.