In any company or business, we need stable cash availability to run business smoothly. A company needs a certain amount of time to convert investments into cash. In this determination, a calculation called cash conversion cycle or CCC is needed. This calculation will greatly facilitate the company in calculating the level of inventory or cash, until to pay the debts.

If you want to know the exact method to calculate the cash conversion cycle then you should have its proper definition or concept in mind,

Because from this definition we will more easily understand the calculation process accurately. The following is a complete description of the definition of a cash conversion cycle.

What is Definition of Cash Conversion Cycle?

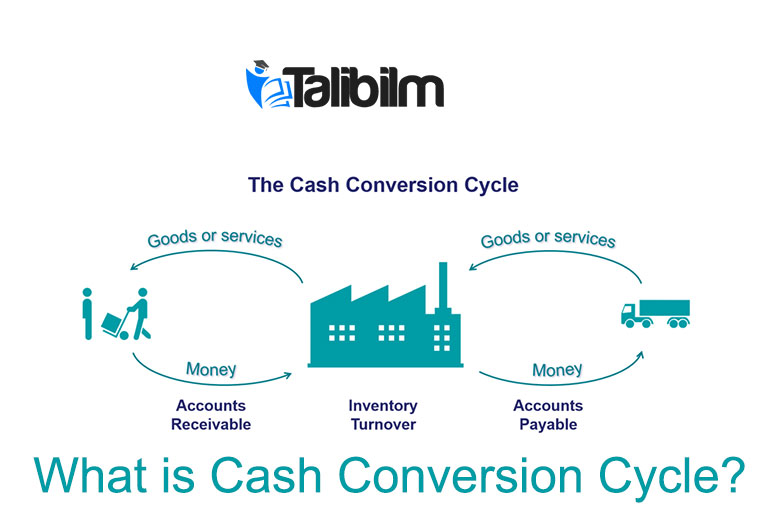

What is Cash Conversion Cycle? Cash Conversion Cycle in simple meaning is that when a business management converts investments which is in form of inventory into cash format. A specific time is required to do so and that is studied and analyzed in detail. The cash conversion cycle has a formula to measure the amount of time, day, and then the company uses it to convert its resource input into cash.

It can also be said that the cash conversion cycle or CCC is a calculation to measure how long cash is bound in inventory before the inventory is sold and cash is collected from customers.

What is cash conversion cycle formula?

The cash conversion cycle formula is:

Cash Conversion Cycle = DIO + DSO – DPO

- DIO is an Outstanding Days Inventory

- DSO is an Outstanding Sales Day

- DPO is a Days Payable Outstanding.

In this formula you have seen three different terms which need our attention if we want to understand this subject easily.

DIO means what is the current inventory level and how many days or time a company needs to sell the inventory without any hard difficulties.

This stage, called Outstanding Days Inventory, is calculated using today’s inventory calculation.

What is DSO? While the second stage represents current sales and the amount of time needed to collect cash. Days of Outstanding Sales are calculated using the day of sales calculation.

What is DPO? And in the third stage is the current debt representative. In this stage, it is shown how much the company owes the vendor and when the company must pay it off. At this stage the calculation of debt payable is considered.

What are Outstanding Days Inventory (DIO)?

This is the number of days and the average it takes for the company to turn its inventory into sales. DIO is basically the average number of days a company stores its inventory before selling it.

Definition of Days Payable Outstanding?

This is defined as the average time or average number of days in which a business owner tries to repay debts. The DPO measures the average number of days or time when a company wants to pay invoices without taking extra loan. These invoices are normally taken from trade creditors.

Calculating the Cash Conversion Cycle

As mentioned earlier, to calculate CCC is done by the formula: DIO + DSO – DPO. Then we can interpret the formula into three parts. The first term means how many days we need to sell the inventory at no extra cost. And how would be requirements to sell inventory.

The second part measures the time it takes for the company to raise cash.

Similarly, a company also needs to evaluate that how many days it needs to pay amount to the suppliers. Therefore, the cash conversion cycle is deemed as a cycle where the business would be purchasing stock, selling inventory or buys on credit. It also gets receivables and then converts into cash.

These are important steps for a company to sustain in the market. We should be expert in the calculation of Cash conversion cycle. In this way we can keep the company or business on the right track. We can have many issues if we don’t keep the extra cash flow to meet the company’s expenses it means we are doing wrong practice.