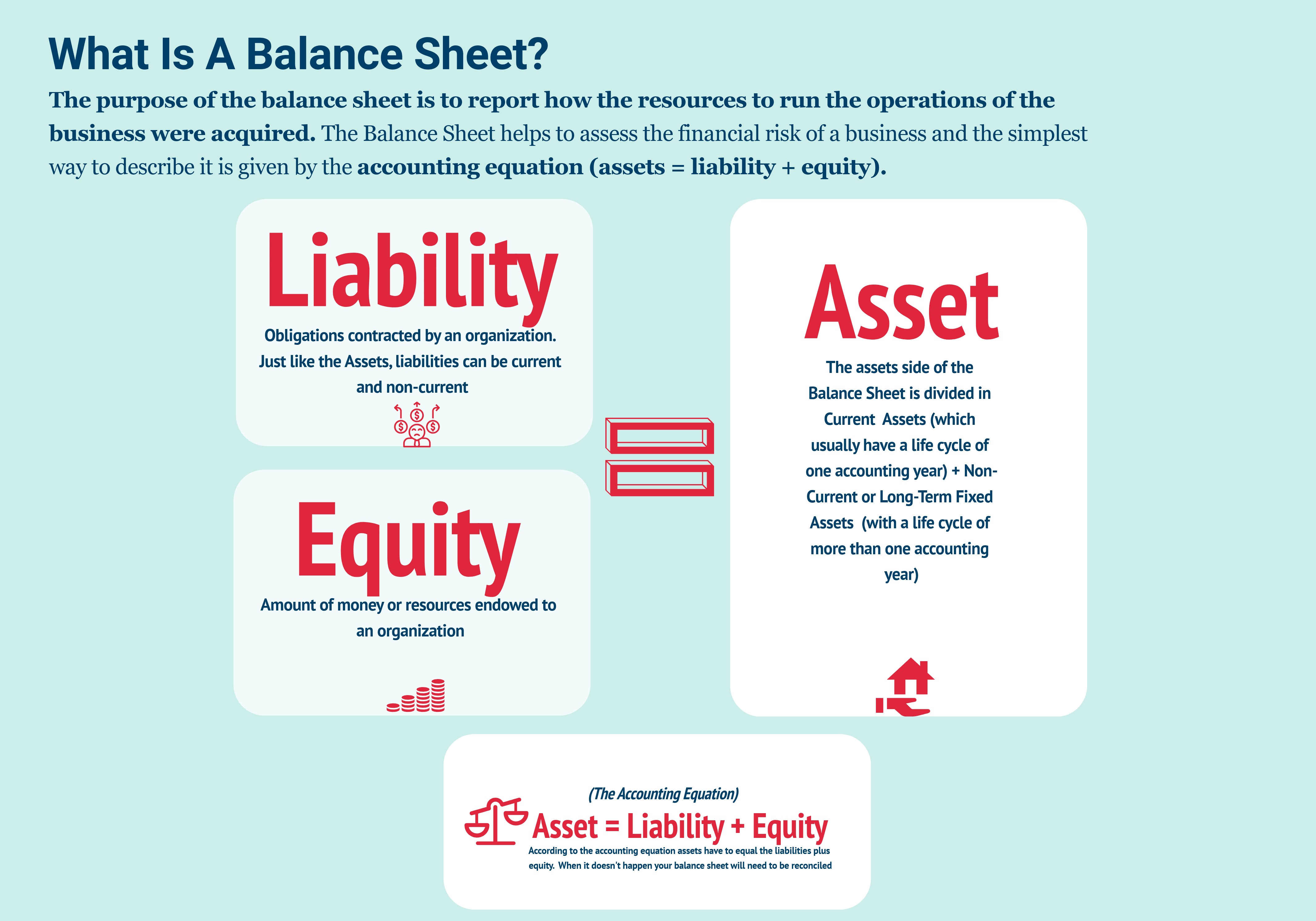

How to Make a Balance Sheet? An accounting report, that gives a synopsis of the financial of a company for a definite period, is known as a balance sheet. It is also referred to as a statement of financial position, or a swift report that tells the company’s liabilities, equity, and assets in one page.

It is very essential to know how a balance sheet is to be made. The owners of the business review it to trail the company earnings and expenditures. Creditors and money lenders use balance sheet data to make various decisions; whether a company qualifies to be given a loan or it deserves a corporate credit card. What a business company owns v/s what shares it owes become the base of examination and a framework of decision making related to investment for a person with a potential credit. All the three scenarios stated above are the most typical ones, still there are various practices for which a balance sheet can be used.

Most balance sheets are arranged according to this equation: Assets (of the company) = Liabilities (concerned ones) + Equity of the shareholders (within the company)

How to formulate a balance sheet?

Following are the tips that can be employed to create a balance sheet for a company. Though some or most of the process be automated by the usage of various accounting softwares or systems, yet the knowledge of preparing a balance sheet enables one to spot the errors within the sheet, so that they may be resolved- before they get the potential to cause an everlasting harm.

Following are the five steps:

- Firstly, the date and the period of the reporting must be determined.

A balance sheet must be able to give a complete account of the total liabilities, assets, and the equity of the shareholders of a company on a particular date which is most often the final day of reporting date when the balance sheet is submitted. Many companies report on the quarterly intervals of the year.

- Secondly, the assets of the organization(s) must be calculated.

Usually, a balance sheet would arrange the asset-lists in two ways: firstly, as individual line-items i.e. current assts; and secondly as total assets i.e. non-current assets. Thus, the process of splitting the data into two such ways would make it quite easier for the analyst in understanding what exactly the assets of the organization are, and from where they have been collected.

- Thirdly, you must identify the liabilities of the organization.

The liabilities are also to be divided into two major categories for better analysis: current liabilities and non-current liabilities. Just like the assets, these are also to be subtotaled and then totaled together.

- Fourthly, the equity of the shareholders is to be calculated.

If the company has a single owner then, everything would be quite straightforward. However, if it is publicly owned, then the classification would be complicate, and is to be made on various types of the stock issued.

- Last, add the total liabilities to the total equity of the shareholders, and then, compare to the assets of the organization.

Make sure that the balance sheet is well balanced, and for it, total assets needs to be compared against the total liabilities plus the equity of the shareholders.